As of 01/08/2026

Indus: 49,266 +270.03 +0.6%

Trans: 18,058 +196.68 +1.1%

Utils: 1,055 +7.08 +0.7%

Nasdaq: 23,480 -104.26 -0.4%

S&P 500: 6,921 +0.53 +0.0%

|

YTD

+2.5%

+4.0%

-1.2%

+1.0%

+1.1%

|

50,000 50,000 or 48,000 by 01/15/2026

18,400 18,400 or 16,800 by 01/15/2026

1,040 1,040 or 1,100 by 01/15/2026

22,400 22,400 or 24,500 by 01/15/2026

7,250 7,250 or 6,700 by 01/15/2026

|

|

As of 01/08/2026

Indus: 49,266 +270.03 +0.6%

Trans: 18,058 +196.68 +1.1%

Utils: 1,055 +7.08 +0.7%

Nasdaq: 23,480 -104.26 -0.4%

S&P 500: 6,921 +0.53 +0.0%

|

YTD

+2.5%

+4.0%

-1.2%

+1.0%

+1.1%

|

50,000 50,000 or 48,000 by 01/15/2026

18,400 18,400 or 16,800 by 01/15/2026

1,040 1,040 or 1,100 by 01/15/2026

22,400 22,400 or 24,500 by 01/15/2026

7,250 7,250 or 6,700 by 01/15/2026

|

|

Bulkowski on the Big W Chart Pattern

Updated and added 10 examples on 7/16/25.

A big W is a double bottom with tall sides. Price often confirms the double bottom and approaches the height of the left side trend start before retracing and forming a handle.

Once price completes the handle, the rise resumes. For a more detailed analysis of this pattern, buy a copy of Encyclopedia of Chart Patterns, 3rd Edition (#AD).

A Big W chart pattern

Big W: Important Bull Market Results

Overall performance rank (1 is best): 11 out of 39

Break even failure rate: 9%

Average rise: 46%

Throwback rate: 64%

Percentage meeting price target: 74%

The above numbers are based on more than 2,100 perfect trades. See the glossary for definitions.

Big W: Identification Guidelines

| Characteristic | Discussion |

| Price trend | Downward leading to the pattern. |

| Shape | A big W shape with twin bottoms and tall sides. |

| Reversal pattern | Look for a double bottom reversal pattern at the base of the big W. |

| Tall sides | The best performing big W chart patterns have tall, straight declines leading to the bottom of the big W. |

| Rise between bottoms | The rise between the valleys of the double bottom is 10% to 20% or more (but be flexible). |

| Volume | Recedes 69% of the time between the two bottoms. |

| Breakout Confirmation | The pattern confirms as a valid one when price closes above the highest peak between the two bottoms. |

Big W: Trading Tips

Consult the associated figure on the right.

| Trading Tactic | Explanation |

The Measure Rule

|

| Measure rule | Compute the height from the highest peak to the lowest valley (D-B) and then add the result to the

price of the peak high, D. The result is the target price. The link to the left gives more information about the measure rule. |

| Breakout | Occurs when price closes above the peak high (D). |

| Stall | For swing traders, buy at the double bottom low (E) and ride price upward to confirmation of the double bottom (the high between the two bottoms, D). Price often

pauses there. If price drops below the low of the second bottom (E), exit the position immediately. If price confirms the double bottom, expect a rise approaching the left side high (A). |

| Position traders | Wait for confirmation of the double bottom before taking a position and be prepared to sell as the stock nears the

price of the left side high (the price at C approaches the price at A). |

Big W: Example

The above figure shows an example of a big W chart pattern. Price begins its decline at A and reaches a low at B in just a few months. Price bounces and retraces to form

a second low in September (C). The Eve & Adam double bottom confirms as a valid chart pattern when price closes above the confirmation

line, as shown. A nice-looking symmetrical triangle appears during October.

More

More

Other Big W Examples

Big W: Trading Lessons

I present the information in slider format, so be sure to click the left or right arrows to view another slide.

Lessons Summary

- Slide 1. After an ABC correction ends, consider buying a motive wave up.

- Slide 2. A measured move down might see price retrace to the corrective phase (limiting the rise from the big W) before resuming the drop.

- Slide 3. Beware taking a position in a stock with a bad earnings surprise.

- Slide 4. Look for chart patterns and avoid bearish ones.

1 / 4

If you believe in Elliott wave, then look for an ABC correction. After price advances in 5 waves (higher in this case), you'll see price drop, retrace, and drop again

as the red ABC lettering shows. After the ABC pattern ends, we see a Big W form. The belief is that you'll see price rise again in 5 or more waves. If that's true (I don't know if it is), then this setup

is a high probability winner.

The green circle outlines the ABC pattern.

Next chart please.

2 / 4

In the chart pattern world, an ABC correction is called a measured move down (MMD). In a MMD, price drops, retraces, and drops again. However, after the pattern completes,

look for a return to the corrective phase (BC).

Using letters, the measured move is ABCD. Leg CD is supposed to equal leg AB, but rarely does. The corrective phase is BC and it posed overhead resistance to an advance.

In this example, the stock reversed in the corrective phase, causing a loss.

Next chart please.

3 / 4

Here's an example of an event pattern called a bad earnings surprise. After the announcement of earnings, the market doesn't like the results and the stock gaps down.

After a week to 10 days, you'll often see price bottom and start to rise. However, because earnings are so important, the stock may falter and reverse as in the case here, resulting in a losing trade.

In other words, check news on the stock. If it's not good, then pick another stock.

Next chart please.

4 / 4

Sometimes a chart screams that a pattern is forming. In this case, the chart pattern is a head-and-shoulders top. I show the left shoulder and head. I drew a green line

to signal where to enter the trade, but already the potential head-and-shoulders was visible. I'd avoid the trade because of the bearish head-and-shoulders top.

Indeed, a right shoulder formed and the stock returned to the level of the launch price.

The end.

❮

❯

Big W: 10 Examples

The following is a slide show. Click the right or left arrows, or the circles below the chart to navigate around the slides.

1 / 10

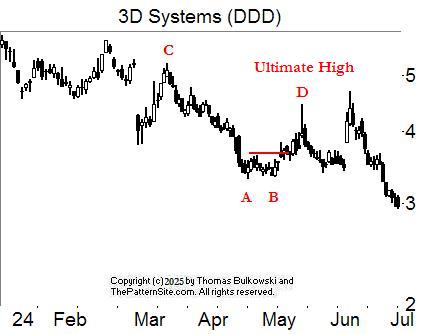

This is an example of a big W chart pattern. The big W is at AB. Price has a tall side that begins at C and price drops to A. From B, it only makes it up to D before tumbling. D is the ultimate high,

the highest price reached before the stock dropped by more than 20%.

The next chart gives more examples.

2 / 10

This is the way a big W should work! The pattern is at AB. D is the launch price where the downtrend begins. And C is the recovery high (so far).

The next chart gives more examples.

3 / 10

This big W (AB) has not reached its full potential (C) yet (D).

The next chart gives more examples.

4 / 10

The AB big W sees price rise to C, where it reaches the ultimate high. It doesn't come close to the target of the high on the left side. In these ten examples, I show the target as the top of the tall left

side and not the one computed by the measure rule.

The next chart gives more examples.

5 / 10

I show this big W on the weekly chart to fit it on the screen. AB is the big W. C is the target. D is how high the price climbed so far. The rise to D is because of a buyout offer from Home Depot.

The next chart gives more examples.

6 / 10

This big W (AB) also sees price at D reach the target C.

The next chart gives more examples.

7 / 10

The big W at AB sees price rise to E before tumbling and forming a triple bottom (ABC). At F, the stock exceeds the left side of the big W (D).

The next chart gives more examples.

8 / 10

Big W AB has a throwback pattern at D after reaching the height of the left side of the pattern, C. A throwback appears 64% of the time in big Ws.

The next chart gives more examples.

9 / 10

This big W (AB) gave up trying to reach the height of the left side, C.

The next chart gives more examples.

10 / 10

Big W AB meets the target C at D. Looking back farther to the left, we see another target E. Price reached that target, also.

The End.

❮

❯

-- Thomas Bulkowski

See Also

Support this site! Clicking any of the books (below) takes you to

Amazon.com If you buy ANYTHING while there, they pay for the referral.

Legal notice for paid links: "As an Amazon Associate I earn from qualifying purchases."

|

My Stock Market Books

|

My Novels

|

Copyright © 2005-2026 by Thomas N. Bulkowski. All rights reserved.

Disclaimer: You alone are responsible for your investment decisions. See

Privacy/Disclaimer for more information.

Some pattern names are registered trademarks of their respective owners.

Any minute now I'll jump in with pointless observations.

![]()