As of 03/04/2026

Indus: 48,739 +238.14 +0.5%

Trans: 19,712 +26.63 +0.1%

Utils: 1,178 +4.82 +0.4%

Nasdaq: 22,807 +290.79 +1.3%

S&P 500: 6,870 +52.87 +0.8%

|

YTD

+1.4%

+13.6%

+10.3%

-1.9%

+0.4%

|

50,500 50,500 or 47,900 by 03/15/2026

20,200 20,200 or 18,150 by 03/15/2026

1,300 1,300 or 1,160 by 03/15/2026

24,750 24,750 or 21,800 by 03/15/2026

7,250 7,250 or 6,600 by 03/15/2026

|

|

As of 03/04/2026

Indus: 48,739 +238.14 +0.5%

Trans: 19,712 +26.63 +0.1%

Utils: 1,178 +4.82 +0.4%

Nasdaq: 22,807 +290.79 +1.3%

S&P 500: 6,870 +52.87 +0.8%

|

YTD

+1.4%

+13.6%

+10.3%

-1.9%

+0.4%

|

50,500 50,500 or 47,900 by 03/15/2026

20,200 20,200 or 18,150 by 03/15/2026

1,300 1,300 or 1,160 by 03/15/2026

24,750 24,750 or 21,800 by 03/15/2026

7,250 7,250 or 6,600 by 03/15/2026

|

|

Bulkowski's 2025 Forecast Update

Below is the updated forecast for 2025 as of the close on December 31, 2024. Captions appear below the pictures for guidance, so be sure to scroll down far enough to read them.

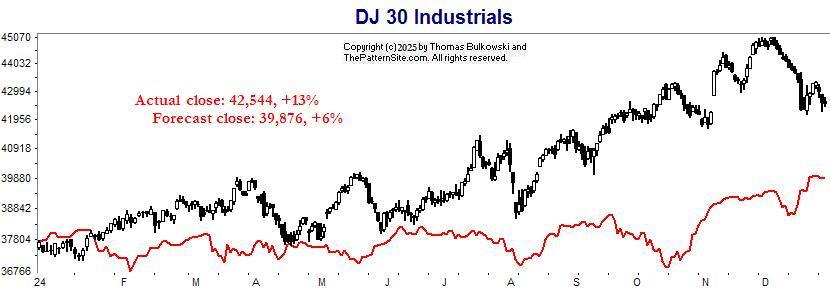

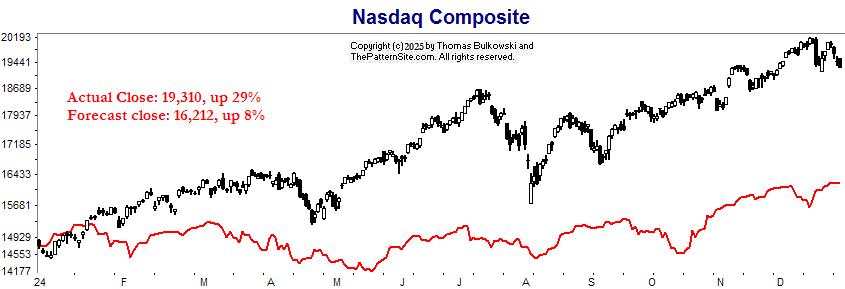

On some of the charts (all except the CPI chart) the prediction in red is based on the work of Edgar Lawrence Smith in the 1930s. Smith said that the stock market followed a 10-year cycle.

Each year tended to repeat the behavior of the year a decade earlier. In other words, if you averaged all years ending in 1 (2001, 1991, 1981 and so on), that would give you a forecast for

2011. For 2012, you'd make a similar average, only use 2002, 1992, 1982, and so on. That's what I did for the market forecast charts which follow.

1 / 5

In the box on the upper left is a review of the market performance for 2024. The numbers reflect price changes only and exclude dividends.

I did an Internet search and found these values for the indices with dividends included: Nasdaq composite: 29.57%, S&P 500 index; 25.02%, and Dow industrials: 14.99%.

How do your portfolio or trading results compare with your favorite index? If you underperformed the indices by a lot, then consider investing instead of trading (for at least a part of your portfolio).

ETFs will underperform their benchmark because they have to pay expenses of running the fund.

I show the year-to-date results of the indices I follow. In first place was the Nasdaq followed by S&P, Dow industrials, Dow utilities, and Dow transports.

The chart shows the Nasdaq which is projected to rise 9% this year. If the forecast is correct, mid July should see a peak in the index, followed by weakness going into late August, and additional weakness ending

late September.

The next chart looks at the CPI. Not that CPI, the Chart Pattern Indicator!

2 / 5

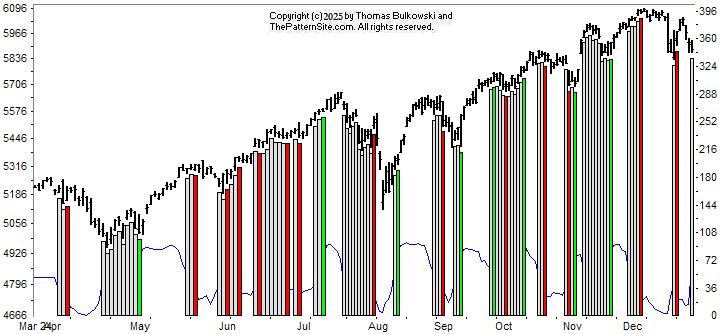

This is a chart of the Chart Pattern Indicator (CPI) on the daily scale.

The indicator is neutral (white vertical bar). You can see that with the white bar on the far right of the chart.

The next chart looks at the Dow industrials.

3 / 5

This is what happened to the Dow industrials in 2024 compared to the forecast made in January for the year. As you can see the index climbed away from the forecast to end the year 13% higher.

The next chart looks at the Nasdaq forecast.

4 / 5

This is the Nasdaq. It climbed 29% higher, doing much better than the forecast 8%.

The S&P 500 forecast for 2024 is next.

5 / 5

Here's the S&P 500 index on the daily scale for 2024. The S&P 500 was also supposed to climb by 8% but actually posted a 23% gain.

The end.

❮

❯

See Also

Support this site! Clicking any of the books (below) takes you to

Amazon.com If you buy ANYTHING while there, they pay for the referral.

Legal notice for paid links: "As an Amazon Associate I earn from qualifying purchases."

|

My Stock Market Books

|

My Novels

Orb Foresight Rewrite Coming!

|

Copyright © 2005-2026 by Thomas N. Bulkowski. All rights reserved.

Disclaimer: You alone are responsible for your investment decisions. See

Privacy/Disclaimer for more information.

Some pattern names are registered trademarks of their respective owners.